The narrative of the humanoid robotics revolution has been one of relentless optimism: breathtaking demos, billion-dollar valuations, and promises of a labor revolution just around the corner. Yet, beneath the glossy surface of progress, the immutable laws of physics, economics, and business execution remain. The recent, quiet collapse of “Atlas Robotics” (a pseudonym for a real, now-defunct startup that raised over $150 million from top-tier investors) serves as a stark, necessary counter-narrative—a cold shower for an overheated industry. Its failure is not merely the shuttering of another tech startup; it is a canonical case study in how grand vision, abundant capital, and technical talent can still combust when divorced from commercial reality. What crucial lessons does this high-profile stumble impart to an industry still defining its path to market?

Atlas Robotics launched with a fanfare characteristic of the era. It was founded by renowned AI researchers, its pitch decks featured renderings of sleek humanoids performing complex tasks, and its early, heavily edited teaser videos promised near-term autonomy. It secured funding at a pace that suggested the “hard part” was over. Yet, two years after its last funding round, it ceased operations, its assets sold for pennies on the dollar to a competitor. This post-mortem analysis, based on insider accounts and industry expert commentary, dissects the root causes of this failure, extracting painful but essential lessons for founders, investors, and the entire ecosystem about the perilous gap between a compelling demo and a viable product.

The Root Causes: A Perfect Storm of Missteps

The demise of Atlas Robotics was not the result of a single catastrophic error, but a confluence of strategic, technical, and managerial failures.

1. The Premature Product-Market Fit Fantasy: The company’s fundamental flaw was building a solution in search of a problem. Its vision was “a general-purpose humanoid for the home and workplace,” an ambition so vast it precluded a focused go-to-market strategy. While competitors like Agility Robotics targeted logistics or Apptronik focused on upper-body manipulation, Atlas Robotics tried to conquer everything at once. It spent years and the majority of its capital trying to build a robot that could, in theory, do hundreds of things, rather than one that could do a handful of commercially valuable tasks exceptionally well and at a known cost. When pressed by investors for a revenue timeline, the roadmap was always “18 months away,” a horizon that perpetually receded.

2. Technology Led, Market Followed (Into a Chasm): The company was engineering-driven in the worst way. It prioritized research breakthroughs—like a novel, proprietary actuator or a more fluid walking gait—over system integration and reliability. The team excelled at creating impressive one-off demonstrations for investor roadshows but struggled to produce a single, unified platform that could operate for more than an hour without a critical failure. The “works-in-the-lab” prototype never matured into a “works-in-the-world” product. This is a classic pitfall: mistaking technical novelty for commercial readiness.

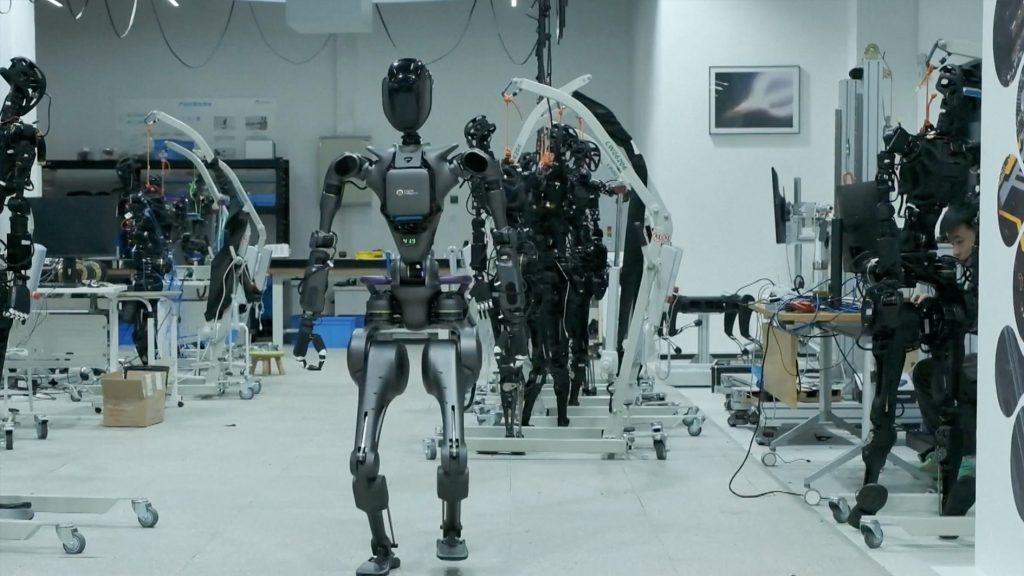

3. Runaway “Science Project” Burn Rate: With a war chest of over $150 million, discipline evaporated. The company expanded to a team of over 200 within two years, hiring top talent at Silicon Valley premiums across multiple, competing research tracks. It built a state-of-the-art lab that was more showpiece than efficient workshop. The burn rate skyrocketed to nearly $4 million per month, with little accountability for translating that spend into shippable milestones. Cash was treated as an infinite resource, a mindset that guaranteed catastrophe when the next funding round failed to materialize.

4. Leadership’s Reality Distortion Field: Founders, brilliant in their respective academic fields, were ill-equipped for the brutal productization and operational challenges of robotics. They insulated themselves from skeptical voices, both internally and from potential early-adopter customers who expressed concrete, scaled-down needs. The board, dazzled by the founders’ pedigrees and the sector’s hype, failed to impose necessary financial and strategic guardrails until it was too late.

Investor Lessons: A New Due Diligence Doctrine for Hard Tech

The Atlas Robotics debacle has sent shockwaves through venture capital, particularly those funds that made bold bets on the “future of work.” It has catalyzed a profound recalibration of due diligence for deep tech and robotics investments.

- From Demo to Data: Investors are now intensely focused on operational metrics over demo-day theatrics. Key questions have shifted: What is the Mean Time Between Failures (MTBF) for the core platform? What is the success rate on your primary use case, measured over 1,000 trials? What is the Bill of Materials (BOM) cost today, and what is the proven path to reduce it by 70%? A slick video of a robot folding a towel once is no longer enough; the demand is for statistical proof of robustness and scalability.

- The “First Dollar” Test: VCs are now insisting on a clear, near-term path to a first revenue-generating contract, even if it’s a pilot. They want to see a specific, named customer with a defined pain point and a budget. The strategy must articulate how the company will survive and learn from early, imperfect deployments, rather than holding out for a mythical, perfect general-purpose robot.

- Scrutiny of Unit Economics and Manufacturing Partners: Questions about manufacturing are moving from the later-stage checklist to the Series A conversation. Who is your contract manufacturer? Do you have a signed term sheet? Have you designed for manufacturability (DFM) from the start, or will you need a costly, time-consuming redesign? Investors now view a lack of manufacturing strategy as a fundamental red flag, not a problem for later.

- Founder Readiness for the “Trough of Sorrow”: Investor interviews now probe deeply into founders’ resilience and operational experience. A pure research background is increasingly seen as a risk that must be balanced with co-founders or early hires who have shipped complex hardware, managed supply chains, and navigated the grueling process of moving from prototype to production.

The Industry’s Reaction: A Sobering Moment and the Seeds of Consolidation

The failure has had a clarifying effect on the humanoid robotics sector.

- A Pivot to Pragmatism: Publicly, competitors express somber respect. Privately, there is a frantic reassessment of roadmaps. The rhetoric is shifting from “human-level intelligence” to “task-level reliability.” The focus is narrowing. You hear less about “changing the world” and more about “solving palletization” or “mastering bin picking.” The Atlas stumble has made the entire field more honest about the incremental, grueling work ahead.

- The Consolidation Accelerant: Atlas Robotics’s fire-sale asset auction was a landmark event. Its patent portfolio, specialized hires, and even lab equipment were acquired piecemeal by larger rivals and adjacent automation companies. This is a precursor to a broader wave of consolidation. Well-funded front-runners like Figure, Tesla, and Boston Dynamics will increasingly look to acquire the IP and talent of faltering competitors at a discount, strengthening their own positions. The era of easy money for any team with a humanoid render is over.

- A Reality Check for Valuations: The funding environment has palpably tightened. While the top-tier companies continue to raise, the bar for Series B and C rounds has been raised dramatically. Valuations for pre-revenue humanoid companies are facing downward pressure as investors demand more proof points and de-risk their portfolios. The failure has underscored that this is a marathon, not a sprint, and that capital efficiency is now as important as technological brilliance.

Call to Action

The collapse of Atlas Robotics is not a indictment of the humanoid robotics thesis, but a vital correction to its execution. It underscores that this is perhaps the hardest problem in technology—requiring not just AI and mechanical genius, but also supreme operational discipline, financial prudence, and a ruthless focus on solving a real, paying customer’s problem today. The industry has been handed a costly but invaluable textbook on how not to build a robotics company.

For those who remain, the path forward is clearer, narrower, and harder. The survivors will be those who combine visionary technology with the gritty practicality of a manufacturing CEO, who respect the capital they are given as the finite fuel for a long journey, and who understand that the first chapter of the revolution will be written not in research papers, but in pilot agreements and efficiency metrics from a factory floor.

The Atlas Robotics case is rich with specific, actionable lessons on team building, technology roadmapping, and investor relations. To dive deeper into the financials, the internal decisions, and the boardroom dynamics that led to the failure, we are hosting an exclusive virtual case study session led by a former executive of the company and a VC who passed on the investment. Reserve your spot to gain the unvarnished insights that could determine the success of your own venture or investment strategy.