Overview of Current National Strategies

The humanoid robotics revolution is no longer a distant concept from science fiction—it’s a strategic race among nations. Around the world, governments and private sectors are aligning policies, investments, and industrial frameworks to dominate this next technological frontier. Unlike earlier waves of automation and artificial intelligence, humanoid robotics sits at the intersection of multiple national priorities: manufacturing resilience, eldercare, defense, and technological sovereignty.

The key players—Japan, South Korea, the United States, China, and the European Union—each bring distinct philosophies and roadmaps to humanoid robotics. Japan and South Korea, both long-time leaders in mechatronics and consumer robotics, emphasize social integration and cultural acceptance. The U.S. and China frame humanoids within broader AI and industrial competitiveness strategies. Meanwhile, Europe is pursuing human-centered robotics, focusing on ethics, safety, and long-term sustainability.

In Japan, the Ministry of Economy, Trade and Industry (METI) supports humanoid robotics under its “Society 5.0” initiative, which envisions a seamless fusion of cyber and physical systems. Robots are seen not merely as labor replacements but as social partners. In South Korea, the Ministry of Science and ICT funds national R&D programs for humanoid locomotion, emotional AI, and robotic caregiving as part of its “Robot Industry Vision 2030.”

The United States has taken a more decentralized, venture-driven approach. NASA’s investment in dexterous robotics, the Department of Defense’s DARPA Robotics Challenge, and the private sector’s boom in humanoid startups—such as Figure AI, Agility Robotics, and Tesla Optimus—illustrate a high-risk, high-reward ecosystem.

China, on the other hand, integrates humanoid robotics into its national industrial strategy. The 2023 “Robot+ Application Action Plan” and the 14th Five-Year Plan explicitly prioritize humanoid research and mass production as pillars of AI supremacy. The Chinese government has set an ambitious target: to become the world’s leading robotics manufacturing base by 2035.

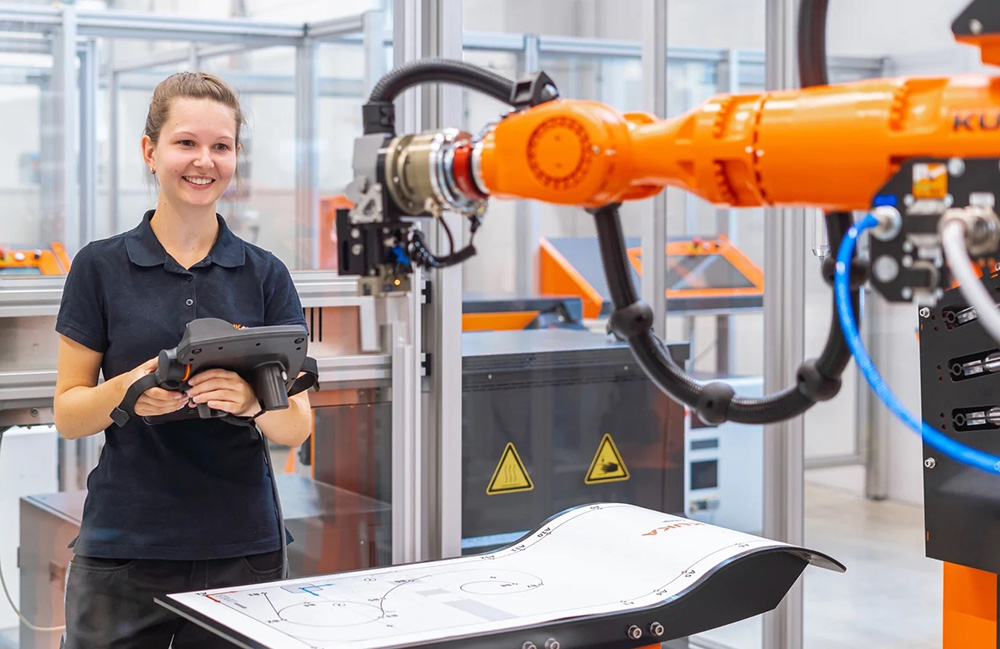

Europe’s approach, led by Germany and the EU’s Horizon programs, is distinct in its ethical and safety orientation. The EU Robotics Flagship Initiative emphasizes “trustworthy AI” and “collaborative robotics,” ensuring humanoids align with human values, labor rights, and sustainability goals.

Thus, the race is not purely technological—it’s ideological. Each nation is defining not only how humanoid robots will emerge but also why.

R&D Investments and Government Funding

Behind every humanoid breakthrough lies sustained research funding. The balance of public versus private investment varies dramatically across regions, shaping innovation outcomes and industrial resilience.

In Japan, R&D investment in humanoid robotics remains deeply institutional. Government-backed collaborations between universities (like Waseda University, home of the legendary WABOT series) and corporations (Honda, Toyota, SoftBank Robotics) sustain a long-term research culture. Japan’s R&D-to-GDP ratio in robotics consistently exceeds 3.5%, among the world’s highest.

South Korea’s National Robot Strategy allocates over $1 billion USD annually to robotics research, with a third of that dedicated to humanoid development. Korean universities like KAIST continue to produce advanced humanoid prototypes such as HUBO and ALPHA, while conglomerates like Hyundai push for practical humanoid deployment in logistics, factories, and healthcare through their acquisition of Boston Dynamics.

In the United States, humanoid research funding is distributed across defense, aerospace, and private tech sectors. DARPA’s early humanoid challenges catalyzed modern robotics entrepreneurship, while NASA’s work on space-capable humanoids such as Valkyrie has influenced terrestrial applications. Venture capital now plays a central role: between 2020 and 2024, U.S. humanoid robotics startups raised over $2.5 billion collectively. Tesla’s “Optimus” project, while initially experimental, symbolizes Silicon Valley’s convergence of AI and mechanical design at commercial scale.

China’s government takes a top-down approach, offering direct funding, subsidies, and tax incentives to robotics firms. Local governments, especially in Guangdong, Shanghai, and Beijing, have established “robot industrial clusters,” complete with R&D parks and dedicated manufacturing zones. State-owned enterprises collaborate with academic research institutes like the Chinese Academy of Sciences to accelerate humanoid breakthroughs.

The European Union’s Horizon Europe program invests in robotics through ethical and industrial frameworks, prioritizing open innovation and cross-border collaboration. Germany’s DFKI (German Research Center for Artificial Intelligence) and Italy’s IIT (Italian Institute of Technology) lead European humanoid research, emphasizing ergonomics and cognitive modeling.

The funding landscape shows one clear trend: while the U.S. and China dominate in scale, Japan and Europe lead in continuity and ethics. The future of humanoid dominance will depend not only on the amount of money spent but on how intelligently it’s allocated.

Comparative Innovation Ecosystems

Each region’s innovation ecosystem reflects its culture, industrial history, and policy orientation. These ecosystems determine not just who builds the best humanoid—but who sustains a scalable, profitable, and socially integrated robotics economy.

Japan’s ecosystem thrives on craftsmanship, reliability, and cultural acceptance of robots. The Japanese public largely views robots positively—as helpers and companions rather than competitors. This cultural harmony translates into early adoption across industries such as eldercare, retail, and public service.

South Korea’s innovation engine is powered by industrial giants. Conglomerates like Samsung, LG, and Hyundai create vertically integrated ecosystems where hardware, AI, and logistics merge seamlessly. Korean startups benefit from strong government support and public-private partnerships that speed up commercialization.

The United States excels in diversity and venture-driven agility. Silicon Valley, Boston, and Austin host clusters of AI and robotics startups that operate at the bleeding edge of innovation. The open-source hardware and software culture accelerates experimentation, though the fragmented regulatory environment sometimes slows mass deployment.

China’s ecosystem is unparalleled in scale. Its vertically integrated supply chains and rapid prototyping capabilities allow humanoid projects to move from concept to mass production faster than anywhere else. The downside is heavy state involvement, which can sometimes stifle creative risk-taking. However, China’s ability to align policy, capital, and labor toward national goals gives it a strategic advantage in manufacturing and cost efficiency.

Europe, particularly Germany, leads in precision engineering and human-centered robotics. The region’s innovation ecosystem is built around universities, research institutes, and ethical frameworks that ensure safety, inclusivity, and sustainability. While slower to commercialize, European robotics often sets global standards in reliability and design philosophy.

The innovation race, therefore, is not one of uniform competition—it’s an ecosystem mosaic. Each country’s strengths fill a different part of the humanoid puzzle.

Key Players and Infrastructure Advantages

In the humanoid revolution, infrastructure and corporate ecosystems define the pace of innovation.

In Japan, Toyota’s “T-HR3” and Honda’s ASIMO legacy continue to influence new humanoid generations. SoftBank Robotics’ “Pepper” and “Whiz” remain icons of consumer-facing robots. Japan’s dense robotics manufacturing base and specialized component industries—motors, sensors, and actuators—offer unmatched supply reliability.

South Korea benefits from cutting-edge research centers like KAIST and strong integration between academia and industry. Hyundai’s robotic division, strengthened by its Boston Dynamics acquisition, gives it an international foothold. The country’s broadband infrastructure and smart-city initiatives create ideal environments for humanoid field testing.

The United States hosts the most dynamic mix of players: Agility Robotics, Figure AI, Tesla, Sanctuary AI (though based in Canada, it has deep U.S. ties), and Apptronik are all pushing boundaries. These firms benefit from access to world-class AI talent, venture funding, and advanced chip manufacturing.

China’s humanoid robotics scene has exploded since 2022. Firms like Fourier Intelligence, Unitree Robotics, and UBTECH Robotics are producing commercial humanoids for logistics, education, and entertainment. China’s core strength lies in its manufacturing ecosystems—component supply chains that can pivot quickly to meet new market demands.

Europe excels in precision, research, and ethical leadership. Germany’s DFKI, Italy’s IIT, and France’s PAL Robotics produce some of the most sophisticated humanoid prototypes in the world. Europe’s emphasis on safety and human-robot interaction standards is shaping the regulatory backbone of global humanoid deployment.

The competitive edge, however, may come from infrastructure alignment—countries that combine innovation, production, and social readiness will lead. Japan, South Korea, and China are ahead in this triad, but the U.S. retains the innovation crown.

Market Outlook to 2040

By 2040, the global humanoid robotics market is projected to exceed $150 billion USD, driven by aging populations, industrial automation, and defense applications. The next 15 years will mark the transition from prototype to widespread deployment.

Asia, led by Japan, China, and South Korea, will dominate manufacturing and consumer adoption. Their combination of cultural acceptance, government support, and production capability will secure global leadership.

North America will remain the epicenter of innovation, software intelligence, and capital. U.S.-based firms are likely to license technology to Asian manufacturers, much like the semiconductor and EV models.

Europe will maintain leadership in regulatory frameworks, ethical standards, and safety certifications. European humanoids will likely occupy premium niches—medical, research, and social interaction.

By 2040, humanoids will have shifted from novelty to necessity. They will assist in eldercare, augment the labor force, operate in extreme environments, and embody the next interface between AI and society. The question is not whether humanoid robots will dominate—but which nations will define the terms of that dominance.

If current trajectories hold, Japan and South Korea will lead socially integrated humanoid adoption, China will lead production scale, the U.S. will lead AI-driven design, and Europe will lead regulation and safety. Together, they will create a multipolar humanoid world—where innovation, ethics, and power intersect.